Hundreds of thousands of bucks in coronavirus relief funds were sent to other folks in the support of bars across the United States, and the IRS desires the money support

By

REBECCA BOONE Connected Press

June 24, 2020, 1: 38 PM

5 min read

BOISE, Idaho —

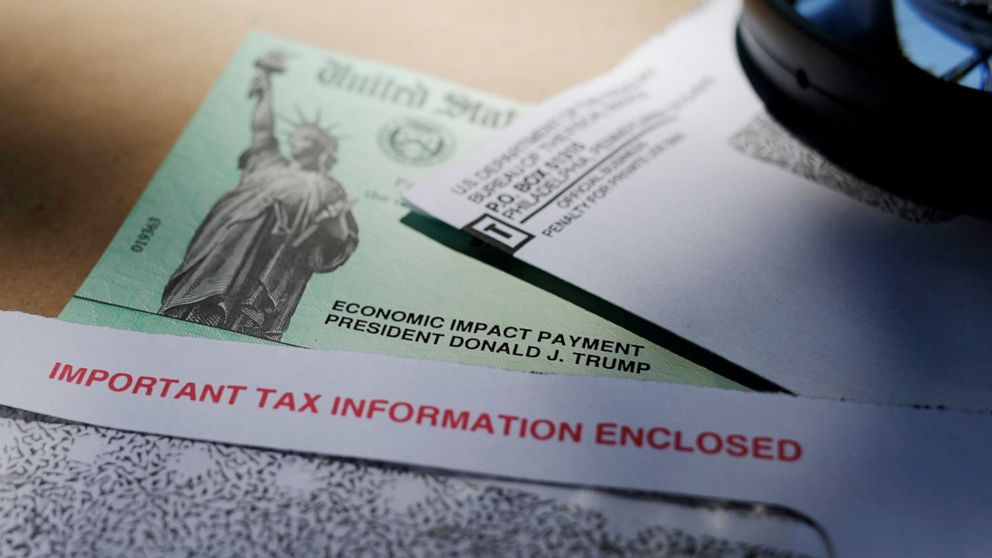

Hundreds of thousands of bucks in coronavirus relief funds were sent to other folks in the support of bars across the United States, and now the IRS is asking suppose officials to relief claw support the money that the federal tax company says used to be mistakenly sent.

The laws authorizing the funds ultimately of the pandemic doesn’t namely exclude jail or penal advanced inmates, and the IRS has refused to order precisely what correct authority it has to retrieve the money. On its website online, it factors to the unrelated Social Security Act, which bars incarcerated other folks from receiving some kinds of former-age and survivor insurance protection profit funds.

“I’m in a position to’t present the correct foundation. All I’m in a position to order you is that that is the language the Treasury and ourselves were the usage of,” IRS spokesman Eric Smith said. “It’s lawful the same checklist as in the Social Security Act.”

Tax authorized professional Kelly Erb, who’s written relating to the topic on her website online, says there might be no correct foundation for soliciting for the checks support.

“I uncover it’s genuinely disingenuous of the IRS,” Erb said Tuesday. “Or now now not it’s now now not a rule lawful since the IRS places it on the web site online. In actuality, the IRS if truth be told says that stuff on its website online is now not at all times correct authority. So there might be no accurate rule — it’s lawful guidance — and that guidance can alternate at any time.”

After Congress handed the $2.2 trillion coronavirus rescue bundle in March, checks of up to $1,200 were automatically sent in most conditions to of us that filed revenue tax returns for 2018 or 2019, including some who are incarcerated. A pair of weeks later, the IRS directed suppose correction departments to intercept funds to prisoners and return them.

The IRS doesn’t yet delight in numbers on how many funds went to prisoners, Smith said. However preliminary data from some states counsel the numbers are colossal: The Kansas Division of Correction alone intercepted greater than $200,000 in checks by early June. Idaho and Montana combined had seized over $90,000.

Washington suppose, meanwhile, had only intercepted about $23,000 by early June. Some states, tackle Nevada, delight in refused to initiate the numbers, citing an IRS ask for confidentiality.

Whereas the IRS says checks sent to jail inmates additionally could well delight in to be returned, the sheer collection of jails and detention facilities across the U.S. makes it refined to order if many are following those instructions.

The IRS seems to thrill in determined by itself to drag support the funds authorized by Congress, said Wanda Bertram, a spokeswoman for the Penal advanced Policy Initiative, a uncover tank specializing in the hurt of mass incarceration. She says penal advanced officials are acquainted with intercepting tax paperwork to screen for doable scams, priming them to put collectively this ask.

“It seems that the IRS is lawful making this up,” Bertram said.

Inmates and their families need the money, she said, in particular as prisons attempt to lower the unfold of the virus by instituting lockdown stipulations or releasing thousands of inmates who are then trying to gain support on their feet.

Lockdowns can form greater charges for inmates because they are regularly given lower-quality meals or fewer meals and favor to supplement by shopping for meals from penal advanced commissaries. Family and buddies on the open air regularly quilt those prices, and hundreds delight in lost jobs ultimately of the commercial downturn, Bertram said.

“Family individuals supreme now are additionally beneath a squeeze due to the pandemic and being out of a job, so could well delight in to you send a stimulus check for any individual, the person in penal advanced is now now not the simply one who advantages from that,” Bertram said.

Intercepting relief checks could well even delight in a disproportionate affect on Unlit and Hispanic inmates, who are incarcerated at a bigger fee than white American citizens. Unlit other folks are imprisoned at roughly twice the fee of Hispanic residents, and bigger than 5 cases the fee of whites as of last year, based mostly fully fully on the U.S. Division of Justice’s Bureau of Justice Statistics.

Penal advanced officials nationwide were trying to intercept the checks, with varying outcomes. Officials in Vermont, Mississippi, Pennsylvania, Arizona and California estimated that they every had intercepted fewer than a dozen checks as of early June. Oregon penal advanced officials had seized 25 funds, with 21 returned to the IRS and four others given to kinfolk or other joint tax filers.

Kaitlin Felsted, a spokeswoman for the Utah penal advanced map, said the suppose had intercepted 28 checks up to now however favorite that any relief money sent to an inmate’s dwelling take care of would now now not be touched by penal advanced officials.

Some states, tackle Alaska and Wyoming, don’t appear to be monitoring the gathering of funds they intercept.

Or now now not it’s now now not sure if inmates delight in any recourse, said Erb, the tax authorized professional.

Those that are launched old to year’s discontinue can order the missing money as a credit on their 2021 tax returns, however other inmates is also out of fine fortune, Erb said.

“I uncover somebody has to sue, and it’s critical to thrill in the sources so that you could perform that,” she said. “I don’t know that there’s anything most other folks can perform moreover whinge and peep in the event that they’ll attract some attention. You’ll want to thrill in somebody who will step up and be an advocate for that section of the population.”

———

Contributing are Connected Press journalists Amy Beth Hanson Jonathan Mattise, Andrew Selsky, Emily Wagster Pettus, Rachel La Corte, Michelle L. Sign, Sign Scolforo, Don Thompson, John Hanna, Mead Gruver, Jacques Billeaud, Lindsay Whitehurst, Sign Thiessen and Wilson Ring.